Renters Insurance in and around Loveland

Your renters insurance search is over, Loveland

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Larimer county

- Loveland

- Windsor

- Fort Collins

- Longmont

- Northern Colorado

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a condo or a house, protection for your personal belongings is beneficial, even if your landlord doesn’t require it.

Your renters insurance search is over, Loveland

Renters insurance can help protect your belongings

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the townhome or home you're renting. So, if you want to protect your valuables - such as a couch, a video game system or a bedding set - renters insurance is what you're looking for. State Farm agent Isaih Levengood has the knowledge needed to help you evaluate your risks and insure your precious valuables.

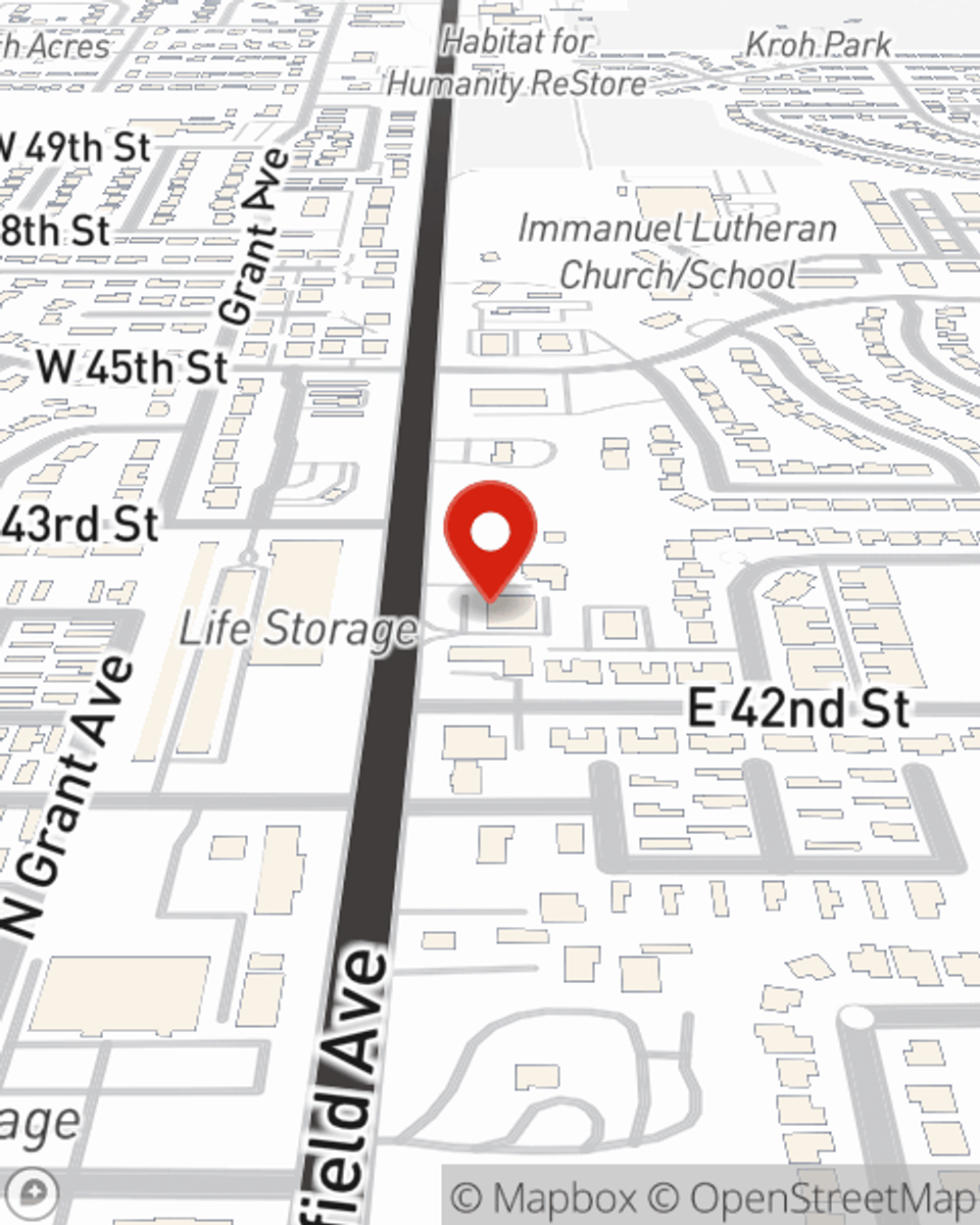

A good next step when renting a condo in Loveland, CO is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and find out how State Farm agent Isaih Levengood can help you.

Have More Questions About Renters Insurance?

Call Isaih at (970) 744-7024 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Isaih Levengood

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.